Most media and politicians seem to have trouble distinguishing between Federal budget deficits and the national debt. But I suspect it’s just another attempt to confuse the public. Budget deficits are the annual amount that government spending exceeds income. And America’s national debt is the total of all Federal budget deficits.

When George Bush took office in 2001 the national debt was 5.7 Trillion (treasurydirect.gov). By the end of his second term the debt was 10.7 Trillion. Five years into Obama’s Presidency, the debt was approaching 17 Trillion. It took over 210 years to accrue a 5.7 Trillion debt and only twelve years to triple the debt. So what has caused the national debt to triple in 12 years? The Congressional Budget Office (CBO) says it will cost taxpayers $8.6 Trillion to prop up big banks after the financial crisis.

One of the most powerful positions in Congress is Chairman of the House Financial Services Committee. This position was held by Democrat Barney Frank until 2010 when Republican Jeb Hensarling became Chairman. During a House debate over the $700 billion bank bailout (TARP), Jeb said the budget deficit rose 800% to 1.2 Trillion, and taxpayers are on the hook for 8 Trillion due to the financial crisis. The Congressional Budget Office (CBO) says it will cost taxpayers $8.6 Trillion to prop up big banks after the financial crisis.

The Federal Budget went over the fiscal cliff in 2008 because of the financial crisis and resulting “Great Recession”. Simon Johnson is a member of the CBO council of advisers, an MIT professor, and former chief economist for the International Monetary Fund. In the clips below from a Senate hearing, Johnson says budget deficits and debt are driven by a drop in government revenue due to the recession. Budget Chairman Kent Conrad and ranking Republican Judd Gregg did not disagree with Johnson’s analysis of the numbers, only his solutions.

Johnson cites J P Morgan CEO Jamie Dimon and former Treasury Secretary Hank Paulson who say they expect another financial crisis in “3 to 7 years”. Based on their prediction, Johnson said another crash of “Too Big To Fail” banks represents a short term budget liability equal to 40% of GDP (5.6 TRILLION), and CBO rules require this be scored in the budget. Ranking Republican Judd Gregg replied, “we don’t score a lot of things around here”, i.e., we’re cooking the books.

Not scoring items in the budget, i.e., keeping items off the books, includes some very big numbers. When Fannie and Freddie collapsed, their 6.3 Trillion of toxic assets and liabilities were dumped on taxpayers, but they are off budget. This article by the Heritage Foundation explains the off budget funding of both wars, which includes 60 billion dollars of waste, fraud, and abuse. Finally, Trillions of dollars of trade deficits have resulted in the selling off of America to foreign governments like Communist China.

In response to exploding Federal deficits and debt, the Simpson Bowles Commission and Super Committee were formed to address the fiscal crisis. They both failed so the Budget Control Act was adopted which allowed Bush tax cuts to expire and implemented spending cuts (sequestration) on January 1, 2013.

Taxes will increase and entitlements will eventually be slashed to deal with the after effects of the Wall Street meltdown(s). But the media narrative never frames the fiscal cliff in a factual context, i.e., exploding deficits and debt are primarily due to the financial crisis and resulting Great Recession, not entitlements and tax policy.

The so called conservative media says welfare programs and tax policy are the driving force behind America’s financial woes. I do believe there’s a seditious attempt to create a socialist culture of dependence, but the facts indicate that this is a top down agenda, not grass roots.

The costs of unemployment compensation, food stamps etc., are substantial, but welfare for the financial elite is an existential threat to our economy and Constitutional rights. For example, Obama wants Trillions for future bank bailouts, without Congressional approval. And yet, “conservative” media says big business needs a tax cut. But Republican tax guru Grover Norquist said, “corporations don’t pay taxes, they collect them from you and me…”.

In order to cover up the cost of toxic assets dumped on taxpayers and Trillions still held by banks, Congress pressured the Financial Accounting Standards Board to relax mark to market rules. These rules require large companies to mark balance sheet assets to current market value. But now, the relaxed rules allow government and banks to falsify the value of toxic assets on their balance sheet. Small business owners would be charged with fraud for engaging is similar accounting practices.

Desmond Lachman is a former Deputy Director of the International Monetary Fund. During testimony before Congress, he said “if the Federal Reserve balance sheet is marked to market, the Fed would have an enormous negative position”. Systemic fraud is the new accounting standard for government and Wall Street.

Political leaders say cutting spending is a priority for restoring fiscal soundness. But if my accountant is cooking the books and embezzling from my business, I can cut spending to zero and still go bankrupt. And that’s what will happen to America if accounting rules promoting fraud are the standard.

The President of the Kansas City Federal Reserve said Too Big To Fail companies “have the availability of different rules” …. “The United States has been the most successful economy in history…because for the most part over it’s history, it has been bound by the rules of capitalism, which does in fact reward success, but also compels participants in the market to play by open rules…and [participants] are compelled to fail when they make poor decisions”. This keeps markets efficient and creates winners based on merit, not privilege.

THE FINANCIAL CRISIS AND US DEBT

Some people say the Community Reinvestment Act (CRA) caused the subprime bubble because it forced banks to make loans to people who couldn’t repay them. But the CRA was enacted in 1977 and had little to do with the 2008 financial crisis. Most of the subprime loans were originated by lenders exempt from the CRA and regulated by the Federal Reserve. And FED Chairman Alan Greenspan had virtually eliminated underwriting standards for mortgage brokers.

Thanks mostly to Greenspan, when the bubble burst, one in three mortgages required no proof of income or assets. As stated by Republican Don Manzullo in the previous link, the Fed could’ve prevented the crisis because it had authority to reduce risk by setting reasonable underwriting standards. But it did not, so in response to the financial crisis, the new Consumer Financial Protection Bureau (CFPB) was created by Obama’s Finance Reform (Dodd-Frank).

This brings to mind Rahm Emanuel, President Obama’s former chief of staff. He said we should never let a serious crisis go to waste because it allows us to do things we could not do before.

So the financial crisis was used to create the CFPB, which is under the authority of the Fed, which did not use it’s authority to prevent the last crisis. OOPS! The CFPB is supposed to protect consumers via new banking regulations. But during a House hearing, Republicans blasted Raj Date, the acting Director of the CFPB, which is just another redundant, unaccountable agency.

Raj said the CFPB would make regulation more efficient. But Republican Mike Grimm said “more government is often the problem”, and if you think its going to be more efficient, “you should probably be medicated”. After asking Raj about the role of mortgage fraud in the financial crisis, Grimm said existing laws could have prevented the crisis, but there was a “big lack of enforcement”.

The Inspector General for TARP said fraud by the nine largest banks led to the TARP bailout. During an open House session in 2004, the FBI warned Congress about a pandemic of mortgage fraud. In this radio interview, William Black begins with the FBI warning and lays out compelling evidence of Wall Street fraud. Mr. Black helped obtain 1000 criminal convictions of “elite” bankers after the 1980’s Savings and Loan meltdown.

Republican Sean Duffy grilled Raj about the role of small banks in the financial crisis. Duffy said his small banks and credit unions had nothing to do with the crisis, but they are bearing the brunt of costly new regulations. Duffy said the original intent of finance reform was to “see what went wrong on Wall Street”, but main street is penalized while Wall Street is bailed out. Duffy compared the CFPB to a dictatorship with no accountability.

Republican Don Manzullo told Raj, “I find it quite frightening that you made the statement that there are tens of thousands of products to be examined to see if they should be regulated”. Then Don talked about the “stupid” regulations he encountered as a practicing attorney closing real estate deals. He told Raj… but now we’re adding more and more regulations… “This doesn’t work Mr. Date…trying to set up a new bureau to do the job that the federal government could’ve done before”.

Wall Street banks use regulation to extract Trillions from taxpayers without Congressional approval. So the Too Big To Fail banks are expanding and buying up the competition while community banks struggle with the compliance costs of new CFPB regulations. This is the result of regulatory capture.

Another example of the fraudulent media narrative is the collapse of Fannie Mae and Freddie Mac (F&F). When investigating their collapse, the Financial Crisis Inquiry Commission (FCIC) discovered evidence of bipartisan fraud. But you didn’t hear about it in the news.

When F&F collapsed, taxpayers were forced to assume their 6.3 TRILLION of toxic assets and liabilities, which are off the Federal budget. F&F were Government Sponsored Entities (GSE’s) until they collapsed in 2008 and were dumped on taxpayers. Prior to their collapse, the Office of Federal Housing Enterprise Oversight (OFHEO), had limited authority to regulate F&F.

James Lockhart and Armando Falcon were former Directors of OFHEO. While testifying before the FCIC, James Lockhart said the 1.5 Trillion taxpayer investment in GSE’s “may never be worth anything”. Mr. Lockhart said “there was no debt discipline for these two companies, people didn’t care if they couldn’t put out a financial statement for five years, people didn’t care if they were starting to lose money”.

The evidence demonstrates that bipartisan leaders worked together to cover up Fannie and Freddie’s systemic risk. FCIC Commissioner Byron Georgiou said both companies were cooking the books. Then he addressed the issue of bipartisan lobbyists who blocked oversight while Fannie and Freddie engaged in illegal accounting practices.

Georgiou said “this was an equal opportunity bipartisan lobbying push over the years when Fannie and Freddie were engaging in this practice…there were well connected people who were either former legislators, or former staffers, and others from both parties, who were retained by these institutions to lobby”. This was “a particularly egregious lobbying abuse”.

Fannie and Freddie’s mission was supposed to be affordable housing, which was the justification for their GSE status. But when asked why F&F didn’t take steps to reduce risk, Mr. Lockhart said “the Boards were much more focused on profitability, they felt that was their fiduciary responsibility to shareholders, the mission was a distant, not even second”.

In the same clip, Commissioner Thomas replied, “my assumption is there was virtually no discussion about taxpayers rather than shareholders”. Lockhart laughed and Thomas said “you don’t have to answer that”. Thomas then cites a Barron’s article saying F&F are insolvent and will be bailed out, followed by an e-mail from Treasury undersecretary Steele saying “it’s way above my pay grade to double the U.S. debt in one fell swoop”.

In 2003, Armando Falcon released a report characterizing F&F as a “systemic risk” to financial markets. A few days before the report was released, Falcon received a call from Fannie Mae CEO Franklin Raines. According to Falcon, Raines “threatened to bring down me and the agency” if the risk report was released.

Then, an official from Treasury called Falcon and said F&F lobbyists were pressuring other agencies to prevent the report’s release. Finally, on the day the report was released, the Bush White House fired Falcon and media focused on his firing while giving “scant coverage” to the systemic risk report. Falcon said this was “the result intended by those who engineered the timing of the announcement of my replacement”.

Who engineered the timing of the announcement? It was the Bush White House who fired Falcon and refused to delay the announcement when Falcon asked them to do so. And national media used the firing to cover up the 2003 risk report. Think about it. On April 9, 2010, Falcon testified under oath that Fannie Mae’s CEO threatened him, and the Bush White House carried out those threats. In this clip, Mr. Falcon recounts the cover up of F&F’s systemic risk and the events leading up to his forced resignation

Fannie and Freddie held 6.3 Trillion of toxic assets and liabilities when they collapsed in 2008, and for the preceding five years, bipartisan leaders in Congress, the Bush administration, and media, covered up the risk to taxpayers. There’s only one reason why this was not a nationwide, front page story, i.e., left, right and center media colluded to cover up the crime. And President Obama’s cover up of this crime makes him an accomplice.

Most of the previous information has been covered up by politicians and media, so it’s important to remember what the financial crisis did to the U.S. economy. Phil Angelides was Chairman of the Financial Crisis Inquiry Commission (FCIC). His comments below are from a 2011 speech, they start at 7min/55sec and end at 15:00.

“Nearly 26 million Americans are out of work, cannot find full time work, or have quit looking for work. Eleven TRILLION dollars of household wealth and retirement savings has been wiped away, vanished like some day trade gone bad…

The public stewards (government regulators) of our financial system failed us, the CEO’s of financial institutions drove their companies over the cliff and our economy with it…

The greatest tragedy coming out of this crisis would be to accept the idea that no one could’ve seen this crisis coming and thus, nothing could’ve been done. If we accept this notion, I guarantee you, it will happen again”.

Presidents Bush and Obama have both said the financial crisis was unforeseen and could not have been prevented. But the FCIC concluded otherwise, and yet, not one media story calls attention to the presidential cover up.

The left says Bush is entirely responsible for the financial crisis, and curiously, the right doesn’t point out President Clinton’s role, which is exposed by the PBS documentary The Warning. It’s about former Commodity Futures Trading Commission (CFTC) director Brooksley Born. The CFTC had authority to regulate derivatives and Born tried convincing President Clinton to reign in the 250 Trillion “dark” market. But Fed Chairman Greenspan and Clinton’s economic advisers “shut her down and shut her up”.

Ms. Born predicted the derivatives market would blow up the economy, hence the documentary’s name “The Warning”. Instead of heeding Born’s warning, President Clinton and his cronies decided to repeal financial regulations that had kept Wall Street speculation in check since the Great Depression.

Clinton’s deregulation of financial markets laid the groundwork for the subprime bubble, and President Bush let Wall Street run wild under the guise of creating more jobs and housing. The Warning exposes bipartisan leaders who are ideologically opposed to regulating Wall Street financial fraud.

Dodd-Frank did not eliminate Too Big To Fail (TBTF) banks, so they’re effectively GSE’s backstopped by taxpayers. This is demonstrated by Moody’s rating of Bank of America debt, which is rated five notches above what it would be without government support. In addition to the explicit taxpayer subsidies for TBTF, Treasury is using Fannie and Freddie as a backdoor bailout for Wall Street. President Obama, who allegedly opposes Wall Street fat cats, says nothing about the government backstop for America’s largest “private sector” banks.

It’s also important to remember that nobody forced Wall Street to BUY worthless subprime loans, securitize them, leverage them 50 to1, put fraudulent Triple A ratings on them, and sell them around the world. In fact, the FBI testified before Congress in 2004 and warned that mortgage fraud would cause a financial crisis. In 2006, mortgage industry experts warned all major lenders that “liars loans” had a “90% incidence of fraud”.

But the industry increased the number of liars loans to the point that 1 in 3 mortgages was a liars loan when the bubble burst. That’s why Neil Barofsky, Inspector General for TARP, said fraud by the nine largest banks caused the need for the TARP bailout. William Black helped obtain 1000 criminal convictions of “elite” bankers after the 1980’s Savings and Loan meltdown. In this radio interview, Mr. Black starts with the 2004 FBI warning and lays out compelling evidence of Wall Street fraud, which has not been prosecuted by Obama’s Department of Justice.

Bottom line, bipartisan leaders were complicit in Wall Street fraud and irresponsible risk taking that drove the economy and budget over the cliff. There’s no economic growth on the horizon that will make up for decreased government revenue due to the financial crisis, and we cannot tax our way out of Trillion dollar deficits.

In order to finance the exploding debt, Obama’s Treasury Secretary wants Congress to eliminate the debt ceiling. In addition to removing the debt ceiling, the executive branch wants authority to spend Trillions on future Wall Street bailouts, without approval from Congress. This will be accomplished via Dodd-Frank’s Resolution Authority, the part of the bill that institutionalizes TARP and gives Wall Street a blank check.

Simon Johnson wrote a book titled “13 Bankers, The Wall Street Takeover and the Next Financial Crisis”. During a Book TV presentation, Mr. Johnson said the six largest banks have “captured the State” and have power to “extort” money from taxpayers. Edward Kane is a senior research fellow at the F.D.I.C., he says the financial crisis and Dodd-Frank are examples of regulatory capture.

What does regulatory capture mean? It means multinational corporations, which by definition are loyal to no country, have subverted representative government. They have enough resources to hire the best accountants, lawyers and lobbyists money can buy, and use them to take over the lawmaking process in Congress. That’s why Obama’s Department of Justice does not prosecute Wall Street CEO’s and their bipartisan partners in crime, let alone implement regulations that represent the interests of American citizens.

The Fed’s loose monetary policy, i.e., toxic asset purchases and 0% money for bailed out institutions, is another hit to the U.S. economy as it drives up commodity prices and incentivizes irresponsible risk taking. KC Fed President Tom Hoenig posed the following question: What resource has ever been efficiently allocated when the price is zero? He was referring to the Fed’s near 0% rate on capital.

Like Simon Johnson, Mr. Hoenig also recognizes the budgetary threat posed by Too Big To Fail banks. He says Dodd-Frank widened the Federal safety net to include high risk gambling activities of large banks. Hoenig proposed reinstating the Glass Steagall Act, which was enacted in 1933 as a response to the 1929 market crash.

Glass Steagall removed high risk investment bank activities from the Federal safety net (F.D.I.C.), but President Clinton repealed it in 1999. It took only 9 years to repeat the crash of 1929. Click here and listen to Mr. Hoenigs comments on TBTF banks. If fiscal and monetary policy had focused on limiting home foreclosures and growing the Main Street economy, increased demand and economic growth would be reducing the deficit.

Congressional budget negotiations have nothing to do with getting deficits and debt under control. The 2014 Federal budget is a prime example. The following text and next paragraph are from an article in USA TODAY: The nearly 1,600-page spending bill includes all 12 of the individual annual spending bills packaged into a $1.012 trillion “omnibus” spending bill. The bill will have gone from unveiling to law in just six days, while the normal appropriations process is structured to take months and allow for more lawmaker input.

Rep. Jim McGovern, D-Mass., holding up the thick bill on the House floor, criticized the House for voting on a bill “that nobody has read.” McGovern cited a concern held by lawmakers in both parties that the details of the omnibus are likely to trickle out after the bill has become law. “I’m willing to bet in a week or so we’re going to read an article about something being in the bill that nobody knew about,”. Jenny Beth Martin, co-founder of the Tea Party Patriots, characterized the bill as a “monstrosity.” She said “while Americans suffer the consequences of Obamacare, Congress is trying to rush through another massive bill before reading it,”

If members of Congress aren’t reading bills, they certainly aren’t writing them. So who is writing legislation? In the case of Obamacare, Dr. Howard Dean said the insurance industry and Democrat staffers wrote the bill (listen to the video in the link). Congress not reading or writing legislation is the MO of Wall Street regulatory capture.

Even Republican tax guru Grover Norquist said, “corporations don’t pay taxes, they collect them from you and me…”. Grover says corporations pass tax liabilities onto consumers by raising the price of their products. But he doesn’t mention that small businesses, which may be corporations, bear the full cost of regulation and taxation because they have limited ability to shift costs to consumers. For possible solutions to regulatory capture, check out the post on the Boston Tea Party.

This highlights the fiscal problem, i.e., large multinationals receive government subsidies while evading tax and regulatory costs. And yet, bipartisan leaders want to lower tax rates for multinationals while raising taxes on small businesses and middle class individuals. No politicians have done more to enrich Wall Street criminals and rob the middle class than Presidents Bush and Obama.

The stock market has nearly tripled in value under Obama while U.S. economic growth is stagnant. Why? Obama and the Fed have given Wall Street everything they want, including near zero percent money and immunity from criminal prosecution. An interesting source is the book Godonomics, which illustrates the Biblical principles behind private property rights and market economies based on moral principles.

TRADE DEFICITS AND THE US DEBT

The fraud that led to the subprime bubble and Great Recession is only half the story behind America’s debt crisis. Pat Mulloy is a member of the US-China Economic and Security Review Commission. He said trade deficits with China will change America from a “shareholder economy to a sharecropper economy”, where China owns large chunks of our economy and we work for them.

In the same clip, Mulloy said the U.S. has run 3 Trillion in trade deficits with China since they were given Most Favored Nation (MFN) status, and it’s “interesting”, China has 3 Trillion in foreign currency reserves. He’s clearly suggesting that U.S. trade deficits contribute to China’s strong cash position. Conversely, trade deficits increase U.S. debt and make America dependent on China for financing the debt.

In the Wall Street Journal article China’s Superior Economic Model, former SEIU President Andy Stern and Intel CEO Andy Grove favor China’s totalitarian economic model. Which means they support China’s use of virtual slave labor, and imprisonment of those who dare speak about democratic reforms. And yet, Obama tells students and union members they’re competing with China. How can students and unions compete with slavery without first becoming slaves?

While U.S. workers and small businesses compete with China, US multinationals have formed partnerships with Chinese State Owned Enterprises. Hmmm? Partners do NOT compete, they work together to achieve common goals. Their goal is a command-control, low wage service economy in America, and global dominance for China’s totalitarian regime.

The origins of treasonous free trade policies can be traced back to Wall Street. Charlie Rose interviewed Jim O’Neill, Chairman of Goldman Sachs asset management, who takes credit for creating the emerging markets, a.k.a. BRIC (Brazil, Russia, India, China). About 29:45 into the interview, Rose mentioned the shift of wealth and power to China and asked Jim what it means for America, a country “used to being on top”. O’Neill said, “I’d like to hear Obama say, how do we adjust, before he says how do we compete”.

Then O’Neill referred to Obama’s former economic adviser Larry Summers saying, “he understands [China’s] relative advantage in international trade.” The idea that America is competing with China is ludicrous. Outsourcing and free trade in the NFL would be comparable to trading a team’s franchise player for the competition’s water boy. Free trade is designed to pick winners and losers in the global economy and Goldman Sachs, a.k.a. Government Sachs, has picked America to lose.

The Federal Reserve has pumped TRILLIONS of dollars into the economy, and yet, U.S. economic growth is stagnant. Why? During an appearance on CNBC, George Soros cites data from the Bank of International Settlements (BIS), which says US and EU banks are the largest supplier of credit to emerging markets. So bailed out banks are financing China’s 8% growth while U.S. growth is stagnant.

April 22, 2010, Rush Limbaugh cited an Investors Business Daily article saying “…despite the commitment of nearly 20 TRILLION in taxpayer funds to prevent another crisis, lending has stalled or shrunk.” So US bank lending to communist China has grown while lending in the U.S. has stalled or shrunk.

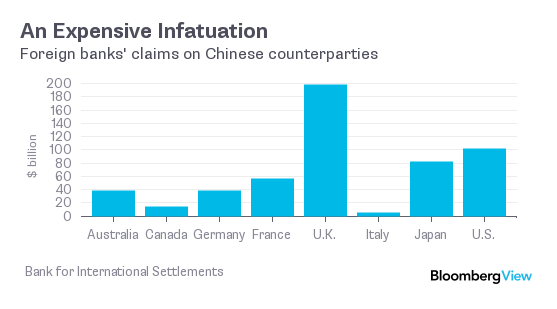

The absolute numbers for big foreign banking systems’ exposure to China are as follows:

Some say the electronic trinkets produced in China would be too expensive if manufactured in America. But virtual slave labor has always existed in foreign countries, and before free trade, America’s economy thrived without exploiting cheap labor abroad. Many leaders say government should be run more like a business. Well, multinational corporations spend billions implementing policies that PROTECT their market share and global competitiveness. They even engage in corporate espionage to gain competitive advantages that US leaders give away via free trade.

Businesses don’t engage in anything remotely resembling free trade. Why? Because providing the competition with capital and technology guarantees failure. Doing so would cause shareholders to demand criminal prosecution of the Board of Directors and top officers, which is what should be done to politicians who have intentionally traded away America’s economic future. Manufacturing is the engine of economic growth, so outsourcing manufacturing in exchange for cheap trinkets is like the Native Americans selling their sovereignty for beads and blankets.

American history teaches the concept of manifest destiny. But how many fur traders, homesteaders and gold miners were thinking about manifest destiny when they moved West? Few if any, they didn’t even know what the phrase meant. Manifest destiny is the language of ruling class elites, i.e. merchant bankers and industrialists. They moved common folk across the American West like pawns on a chess board. Ruling class elites wanted conflict with the Indians so they could call in the cavalry and manifest their destiny.

The new frontiers for today’s ruling class are Communist China and emerging markets. Free trade is preparing the way for the global cavalry and final phase of manifest destiny. For all intents and purposes, US financial elites and industrialists have seceded from the Union. They’ve allied themselves with China’s totalitarian regime and are engaged in economic terrorism against the United States.

Media and politicians support this treasonous alliance and they exploit class and race divisions as part of a divide and conquer agenda. They want divided Americans to blame each other and fight over the economic crumbs left behind by free trade and the financial crisis. We’re all Indians now.

Bipartisan leaders said free trade would transition America to a “low wage service economy”, a.k.a., de-industrialization. Since the beginning of the Industrial Revolution, industrialized nations have dominated the global economy because manufacturing is the engine of growth.

Case in point, after WWII the German economy was literally a pile of rubble. But seventy years later, in spite of high labor costs, Germany has the strongest economy in the West. Why? They protect their manufacturing base. Don’t buy the lie that America cannot do the same because, transitioning from the world’s largest manufacturer and exporter to a low wage service economy is by definition, a radical economic decline.

Wall Street and their bipartisans cronies have structured the global economy (globalization) in a way that subsidizes China with U.S. capital and technology. The decline in growth resulting from free trade and de-industrialization was masked by the subprime bubble. In my opinion, the subprime bubble was intentionally created to cover up the economic contraction caused by free trade and outsourcing. When the bubble burst, average citizens were blamed for living beyond their means and the structural decline resulting from free trade wasn’t even mentioned.

WAR AND THE US DEBT

CNBC reported that Chinese State owned companies are currently mining a trillion dollars of mineral reserves in Afghanistan. The guest said Afghanistan is the “Saudi Arabia of lithium”. Lithium is used in batteries for electric cars and battery storage for wind and solar farms. So Afghanistan is the first war for “green” energy and U.S. blood and treasure are subsidizing Communist China’s totalitarian regime.

Green energy is a subsidy for China because lithium batteries and solar panels are produced by Chinese manufacturers. After the Iraq war, most of Iraq’s oil is going to China. The objective is to subsidize emerging markets led by China’s totalitarian regime. This will create a neo-feudalistic world where China is the new home of the Global Military Industrial Complex (GMIC).

The US/China partnership allows the respective governments to play both sides of global conflicts, thereby providing guaranteed profits for the GMIC. Iran, North Korea and Syria are prime examples. The US government classifies North Korea and Iran as state sponsors of terrorism. But the CSPAN clips below demonstrate that China supplies Iran with chemical, ballistic and nuclear weapons, and allows trans-shipments of weapons from North Korea to Iran, which then supplies Syria and Hezbollah.

US leaders condemn the actions of Iran, Syria and North Korea, all client states of China, while turning a blind eye to the fact that they could not be a threat to the West without Chinese support. Link1, Link2, Link3, LInk4, Link5 Compelling evidence of bipartisan treason can be found in these posts on Saudi funding of terrorism and China’s totalitarian regime.

Real solutions for the debt crisis begin with enforcing the rule of law as described in William Black’s radio interview. Then, follow Tom Hoenig’s advice and reinstate Glass Steagall, thus removing Wall Street’s high risk gambling losses from the Federal safety net. Next, begin dismantling free trade agreements and replacing them with protectionist policies that have a two hundred year track record of successfully growing the U.S. economy. For more detail, check out my pdf “Knowledge is Power” and the sections on financial markets and solutions.