During the 1980’s and 90’s, the World Bank and International Monetary Fund made loans contingent upon a nation’s ability to uphold the rule of law. These financial institutions defined lawless nations as those where financial elites had achieved exemption from the rule of law and created a culture of corruption.

This post contains evidence that US financial elites and their bipartisan cronies have achieved exemption the rule of law. The resulting culture of corruption is evident to all who’ve been paying attention. For example, Congress voted to exempt themselves from insider trading laws.

For those who think this post is a leftist attack on Wall Street bankers, you should know that the CEO’s of JP Morgan and Goldman Sachs are registered Democrats. And based on the information in this post, they’re hardcore socialists. In fact, insiders have given Goldman Sachs the name “Government Sachs”.

The Congressional Budget Office says it will cost taxpayers 8.6 Trillion to prop up banks after the 2008 financial crisis. Some politicians say the Community Reinvestment Act (CRA) caused the crisis because it forced banks to make home loans to poor people. But most of the subprime loans were originated by lenders exempt from the CRA.

It’s important to remember that many Wall Street banks were buying subprime mortgages on the secondary market, not lending to homeowners who could not repay their loans. No government agency forced Wall Street banks to buy worthless loans, securitize them, leverage them 50 to 1, and sell them around the world with fraudulent Triple A ratings.

Simon Johnson is a former chief economist for the International Monetary Fund and a current member of the CBO council of advisers. He wrote a book titled “13 Bankers: The Wall Street Takeover and the Next Financial Meltdown”. During a presentation on CSPAN, Mr. Johnson said the six largest banks have “captured the State” and have power to “extort” money from government.

President of the Kansas City Federal Reserve, Thomas Hoenig, gave a speech on Obama’s finance reform (Dodd-Frank). He said it didn’t eliminate the threat of future Wall Street bailouts, and Too Big To Fail banks are “inconsistent with the concept of capitalism.” Mr. Hoenig is calling for the reinstatement of Glass Steagall as a means to break up big banks and reduce the threat of future bailouts.

In 1933, Glass Steagall was enacted to curb bank speculation that caused the 1929 market crash and Great Depression. However, President Clinton repealed Glass Steagall in 1999. It only took nine years to repeat the crash of 1929 and Great Recession.

During a Congressional hearing, Rep. Brad Sherman said Dodd-Frank’s Resolution Authority gives the Executive Branch (Obama) authority to spend Trillions on future Wall Street bailouts, without a Congressional vote. This eliminates one of our core Constitutional rights, i.e., no taxation without representation.

Presidents Bush and Obama said the 2008 financial crisis was unforseen and could not have been prevented. They lied. Phil Angelides was Chairman of the Financial Crisis Inquiry Commission, which concluded the crisis was preventable. Listen to 7 minutes of Chairman Angelides speech starting at 7min/55sec. The left blames George Bush for the financial crisis, but the PBS documentary The Warning puts most of the blame on President Bill Clinton.

The Warning demonstrates that the policies of Clinton and Greenspan laid the foundation for the financial crisis. And President Bush went along with Greenspan’s elimination of underwriting standards, which created Trillions of dollars of home mortgages, without proof of income, job, or assets. Oops! Greenspan admitted his flawed ideology contributed to the crisis, but now the Fed is praised for it’s QE to infinity, which is an ongoing Wall Street bailout.

Also watch CNBC’s House of Cards. It demonstrates that ratings agencies used fraudulent computer models to give junk securities Triple A ratings. The models were inherently fraudulent because they were based on the notion that house prices would increase 6% per year, forever. Historically, this notion is false, so the fraud inherent in the models seems to be intentional.

President Obama said Wall Street’s actions leading up to the financial crisis were “legal”. He lied. William Black was Deputy Director of the Savings and Loan Insurance Corporation during the 1980’s financial crisis. He helped obtain a 1000 criminal convictions of “elite” bankers. Mr. Black says public losses from the 2008 financial crisis are “70 times greater” than the Savings and Loan meltdown, but despite compelling evidence demonstrating Wall Street fraud, there have been few criminal prosecutions.

During this radio interview, Black said in 2004, the FBI testified before Congress about an epidemic of mortgage fraud and predicted it would cause a financial crisis. In 2006, all major lenders were warned that “liars loans” had a 90% incidence of fraud. But the mortgage industry increased subprime lending to the point that 1 in 3 loans were liars loans when the bubble burst in 2008. Mr. Black said this constitutes one million cases of fraud per year by the industry.

The interview with Mr. Black includes securities law expert Lynn Stout, who disagreed with Black’s position on the prosecution of bankers. She wrote an article explaining the role of derivatives in the financial crisis. It’s fairly short, requires little knowledge of financial markets, and provides important information regarding the prevention of another derivatives related meltdown.

If you watch The Warning, listen to the interview with William Black, read Ms. Stout’s article, and watch this short clip on naked credit default swaps, you’ll have a solid understanding of the financial crisis. The clip is Michael Greenberger, former director of the Commodity Futures Trading Commission (CFTC). Greenberger and Stout explain how British common law successfully regulated derivatives for 200 years, and returning to the old regulations may prevent another crisis.

Neil Barofsky was Special Inspector General for TARP, the 700 billion dollar bailout program. Regarding the nine largest banks, he said “it didn’t matter if they were cooking the books on their balance sheets, Treasury was giving them money anyway, in fact, if they had even larger holes on their balance sheets due to FRAUD, that would’ve been only more reason for Treasury to give them money.”

Mr. Barofsky had spent the prior eight years prosecuting bank fraud, and when he made the statement about Wall Street fraud, he did not qualify it by saying alleged fraud. And yet, Obama’s Justice Department has not prosecuted a single executive of the nine largest banks. During debate over TARP, Rep. Marcy Kaptur said “high financial crimes have been committed…these criminals have so much political power, they can shut down the normal legislative process of the highest law making body of this land.”

Rep. Brad Sherman led a bipartisan revolt against the TARP bailout bill because much of the money was going to foreign banks. During an interview with Larry Kudlow on CNBC, he said “the bank of Shanghai can transfer all of its toxic assets to the Bank of Shanghai in Los Angeles, its subsidiary, which can sell them the next day to the Treasury”. He continued saying “foreign markets are being told they are getting the money….assets now held in China and London can be sold to U.S. entities on Monday and sold to the Treasury on Tuesday”.

During debate in the House, Sherman said some members were told the U.S. would be placed under martial law if TARP was not passed. Sounds like extortion to me. Rep. Paul Ryan was also on Kudlow with Brad Sherman. It’s interesting that Ryan, a Republican, was for the TARP bailout which allowed government to pick winners and losers rather than the market. Oops!

The banks Fannie Mae and Freddie Mac were allowed to fail. They were holding 6.3 TRILLION of toxic assets and liabilities when they collapsed and were dumped on taxpayers in 2008. The Financial Crisis Inquiry Commission (FCIC) investigated the collapse of Fannie and Freddie. Commissioner Byron Georgiou said both institutions were “cooking the books”, and lobbyists on both sides of the isle protected the banks while they engaged in illegal activities.

The FCIC concluded: 1) the financial crisis was preventable. 2) Regulators looked the other way rather than take action to prevent the crisis. 3) Big banks took irresponsible risks and taxpayers are stuck with bill.

In order to cover up the cost of toxic assets dumped on taxpayers and Trillions still held by banks, Congress pressured the Financial Accounting Standards Board (FASB) to relax mark to market rules. These rules were put in place after Enron’s collapse and require large companies to mark balance sheet assets to current market value. But now, the relaxed rules allow gov’t and banks to falsify the value of toxic assets on their balance sheet. Small business owners would be charged with fraud for engaging in similar accounting practices.

Desmond Lachman is a former Deputy Director of the International Monetary Fund. He said, ”if the Federal Reserve balance sheet is marked to market, the Fed would have an enormous negative position”. Systemic fraud is the new accounting standard for government and Wall Street.

Political leaders say cutting spending is a priority for restoring fiscal soundness. But if my accountant is cooking the books and embezzling from my business, I can cut spending to zero and still go bankrupt. So the first priority is holding Wall Street and bipartisan criminals accountable, then cut spending.

The Government Accountability Office (GAO) did a partial audit of the Federal Reserve’s response to the financial crisis. It revealed that 16 TRILLION has been lent at near 0% interest, much of it to foreign banks, meanwhile, the U.S. economy is starved of capital and investment. The link will get you to Table 8 on page 131 of the GAO report.

The Federal Reserve has a dual mandate: 1) Price stability 2) Full employment. These mandates apply specifically to the domestic U.S. economy, not the global economy. But as noted below, the Bank of International Settlements says US banks are one of the largest providers of credit to foreign markets like China.

Investors Business Daily ran an article saying “…despite the commitment of nearly 20 TRILLION in taxpayer funds to prevent another crisis, lending has stalled or shrunk”. So while bailed out banks are starving the U.S. economy of capital, they’re lending to emerging markets.

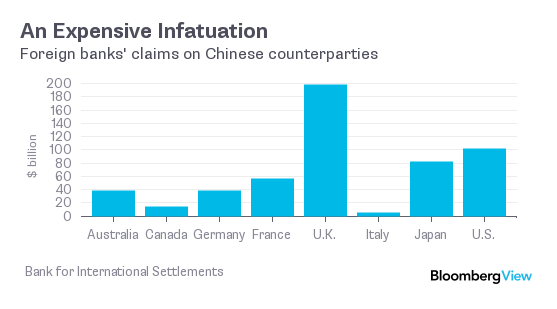

The absolute numbers for big foreign banking systems’ exposure to China are as follows:

George Soros was on CNBC and cited data from the Bank of International Settlements (BIS), he said US and EU banks are the largest supplier of credit to emerging markets like China. So bailed out banks are financing Communist China’s 8% GDP growth while U.S. growth is near zero and the real unemployment rate is 15.1%.

President Obama never mentions the 8.6 Trillion needed to prop up failing banks. Why? According to Open Secrets, Wall Street is one of his biggest campaign contributors. And in return, Wall Street has never had it better, the stock market has nearly tripled in value while economic growth is stagnant.

The Fed’s money printing (QE) policies are driving up the stock market, but it also devalues the dollar so our dollars are worth less, which means we pay more for goods and services. Economists define this inflation as a tax, so when the Fed purchases 40 Billion per month of toxic mortgage backed securities to prop up Wall Street banks, it’s really a tax.

President Obama and the Fed’s policies have dramatically increased income inequality in America, and the top 1% have never had it better. So the Democrats alleged desire to reverse this trend demonstrates their grotesque hypocrisy.

President Obama and bipartisan leaders say economic policies are intended to grow the domestic economy. But it’s not growing. Is this just another oops moment? The evidence indicates otherwise. US policies are designed to subsidize the global economy, a.k.a., globalization. Why?

Bipartisan and corporate leaders prefer China’s totalitarian model. Evidence of this can be found in a Wall Street Journal article titled China’s Superior Economic Model. The article is written by Andy Stern, former President of the Service Employees International Union (SEIU), and the premise of the article was based on comments by Andy Grove, founder and Chairman of Intel.

When Brad Sherman was Chairman of the House Foreign Relations subcommittee on trade, he said US trade with China is “the most unbalanced trade relationship in the history of international trade”, and this “cancerous” trade relationship is driven by “enormous corporate power”. Mr. Sherman forgot to mention union leaders like Andy Stern who also prefer China’s totalitarian economic model. Under the guise of free trade, US leaders are transferring American capital, technology and jobs to communist China.

Rep. Sherman also talked about trade deficits resulting from trade with China, and the effect on the U.S. debt. He said, “you have to have some really bad policies to take the most productive nation in the world with the best workforce, and I mean the United States, and turn it into the greatest debtor nation in history. And by God, we’ve had bad trade policies that have achieved that objective.”

It’s worth noting that Rep. Sherman used the word “objective” when describing the catastrophic effects of free trade. Even Warren Buffet said trade deficits are changing America from a shareholder economy to a sharecropper economy, where foreigners own us and we work for them. Free trade and globalization are an attack on U.S. sovereignty and unalienable rights. Contact your elected officials and tell them so.

Wall Street and their bipartisans cronies have structured the global economy (globalization) in a way that subsidizes China with U.S. capital and technology. The decline in growth resulting from free trade and de-industrialization was masked by the subprime bubble. Given a 2003 warning that Fannie and Freddie posed a systemic risk to financial markets, and the 2004 FBI warning that mortgage fraud would cause a financial crisis, it’s difficult to believe financial and political leaders did not foresee the crisis.

It’s possible the subprime bubble was intentionally created to cover up the economic contraction caused by free trade and outsourcing. When the bubble burst, average citizens were blamed for living beyond their means, but the structural decline resulting from free trade and de-industrialization wasn’t mentioned.

Some say the electronic trinkets produced in China would be too expensive if manufactured in America. But virtual slave labor has always existed in foreign countries, and before free trade, America’s economy thrived without exploiting cheap labor abroad. Many leaders say government should be run more like a business. Well, multinational corporations spend billions implementing policies that PROTECT their market share and global competitiveness. They even engage in corporate espionage to gain competitive advantages that US leaders give away via free trade.

Businesses don’t engage in anything remotely resembling free trade. Why? Because providing the competition with capital and technology guarantees failure. Doing so would cause shareholders to demand criminal prosecution of the Board of Directors and top officers, which is what should be done to politicians who have intentionally traded away America’s economic future. Manufacturing is the engine of economic growth, so outsourcing manufacturing in exchange for cheap trinkets is like the Native Americans selling their sovereignty for beads and blankets.

American history teaches the concept of manifest destiny. But how many fur traders, homesteaders and gold miners were thinking about manifest destiny when they moved West? Few if any, they didn’t even know what the phrase meant. Manifest destiny is the language of ruling class elites, i.e. merchant bankers and industrialists. They moved common folk across the American West like pawns on a chess board. Ruling class elites wanted conflict with the Indians so they could call in the cavalry and manifest their destiny.

The new frontiers for today’s ruling class are Communist China and emerging markets. Free trade is preparing the way for the global cavalry and final phase of manifest destiny. For all intents and purposes, US financial elites and industrialists have seceded from the Union. They’ve allied themselves with China’s totalitarian regime and are engaged in economic terrorism against the United States. Media and politicians support this treasonous alliance and they exploit class and race divisions as part of a divide and conquer agenda. They want divided Americans to blame each other and fight over the economic crumbs left behind by free trade and the financial crisis. We’re all Indians now.

During a hearing on Dodd-Frank’s Resolution Authority, Republican Don Manzullo said it’s a safety net for “you guys that screw up on Wall Street”. Economist Jeffery Miron replied saying the Resolution Authority is a “blank check” for future bailouts, and it will “institutionalize TARP” for bank holding companies.

Dodd-Frank gives the F.D.I.C. resolution authority. The FDIC is under the jurisdiction of the executive branch so future bailouts can be made without Congressional approval. The Constitution states that all spending bills must originate in the House of Representatives, the branch of government most accountable to the people. So allowing the executive branch to spend Trillions without Congressional approval violates a core Constitutional principle, no taxation without representation.

The 2014 budget is another example of taxation without representation because bipartisan members of Congress admitted they didn’t read the bill. If they’re not reading spending bills, they cannot be representing the interests of their constituents, i.e., taxation without representation. The following text and next paragraph are from an article in USA TODAY: The nearly 1,600-page spending bill includes all 12 of the individual annual spending bills packaged into a $1.012 trillion “omnibus” spending bill. The bill will have gone from unveiling to law in just six days, while the normal appropriations process is structured to take months and allow for more lawmaker input.

Rep. Jim McGovern, D-Mass., holding up the thick bill on the House floor, criticized the House for voting on a bill “that nobody has read.” McGovern cited a concern held by lawmakers in both parties that the details of the omnibus are likely to trickle out after the bill has become law. ”I’m willing to bet in a week or so we’re going to read an article about something being in the bill that nobody knew about,”. Jenny Beth Martin, co-founder of the Tea Party Patriots, characterized the bill as a “monstrosity.” She said ”while Americans suffer the consequences of Obamacare, Congress is trying to rush through another massive bill before reading it,”

The key principle of our founding documents is equality before the law, which means no one is above the law. But the U.S. is becoming a nation of women and men who can impose their tyrannical aspirations on sovereign citizens. Criminal elites have created a legal double standard and placed themselves above the law. This was the fundamental problem facing American colonists before the Revolution.

Thomas Jefferson addressed this problem in the Declaration of Independence, which was a criminal indictment of King George that provided a moral and legal basis for the Revolution. The founders ended with these words: “And for the support of this Declaration, with a firm reliance on the protection of divine Providence, we mutually pledge to each other our Lives, our Fortunes and our sacred Honor”.

America’s founders understood the price of freedom, and if we are going to preserve the rule of law they fought and died for, we must be willing to commit time and resources to restore the rule of law. Business Insider reports that Congress has legalized the use of domestic propaganda, which was used to legitimize Germany’s Nazi regime.

This website provides evidence for a criminal indictment of US leaders, however, I’m not advocating for armed rebellion as a remedy. The Constitution and Bill of Rights are still the law of the land, and the law is on the side of “We the People” who believe in unalienable individual rights. We need to create a groundswell of support that will force our public prosecutors to take legal action against criminal elites.

Media and politicians cover up the effect of the financial crisis on the national debt. Check out the post Fraud and the Federal Debt for evidence of the cover up. Use the evidence compiled in the website, share it with your friends, business associates, local prosecutor, Sheriff, State Attorney General and U.S. Attorney.